Come With Receipts

Flashback to this time last year. The team was planning our tax coverage when I said, “I really don’t think the IRS audits anyone who’s not a millionaire.” That night, guess what was waiting in my mailbox? An audit letter from the IRS. ☠️

Whether you've got all your forms organized in a file on your desktop (brava) or you’re just now doing the calendar math to April 15 (we see you), filing can be overwhelming.

We’ve rounded up quick, no-BS answers to your most-Googled tax Qs so you can hit “submit” and move on with your life.

Q: Is it too late to lower my taxable income?

Not too late. You can contribute to your IRA or HSA right up until April 15, which usually helps. After you’re done, here are some other tips.

Q: Should I file singly or jointly?If you’re married, filing jointly usually means a bigger refund. But if your spouse has income-based student loans or owes back taxes, filing separately could protect your refund.

Q: I don't have all my tax forms. What now?Contact your employer and check your online accounts. Many W-2s and 1099s are available through payroll or banking platforms. Still missing something? Call the IRS –– they’ll help wrangle it for you. And ask them if you should file for an extension.

Q: What should I expect to pay in state income taxes?Peep this map for an easy breakdown of individual-income tax rates by state. Oh, and if you live in one of these nine states, congrats.

Q: What if I made money on Venmo or another payment app?In most states, you should get a 1099-K form from the app if you made over $5,000 –– unless you get paid through Zelle, in which case it’s on you to report it.

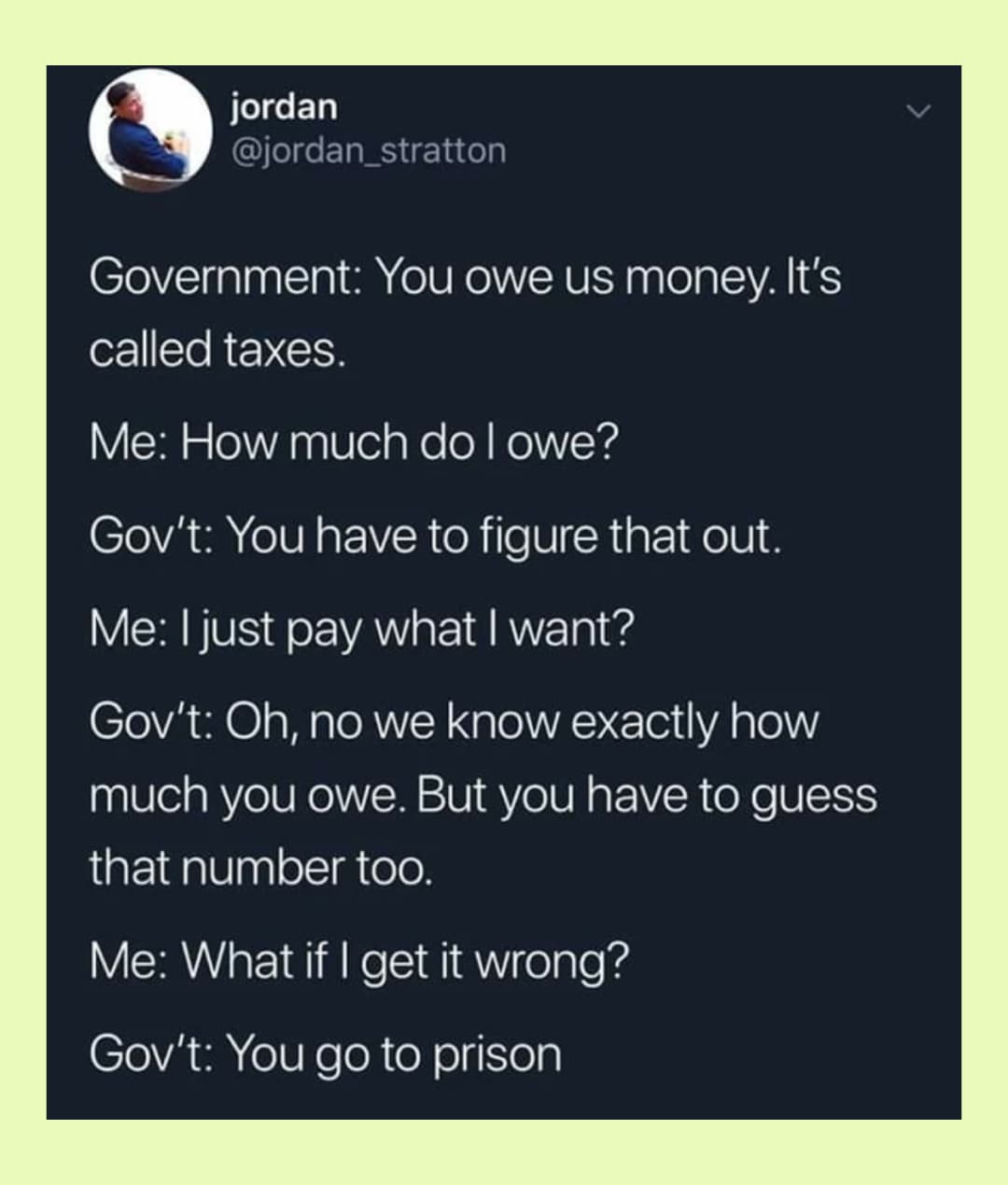

Q: Am I going to get audited???Maybe! But take it from me: No need to freak out. A tax audit = the IRS double-checking your math. In many cases, it’s an easy fix (for me, it was an overlooked 1099) but in others, you’ll need to get your receipts together. This is not a “bang down your door and haul you to jail” situation. Psst… these six common mistakes can lead to an audit.

Q: What if I need more time?You can file an extension to push back your paperwork, but sadly not your payment.

Q: How long do I have to wait for my refund?Most refunds land in your bank account within 21 days. Speed things up by e-filing and choosing to be paid by direct deposit.

Q: Will the IRS hiring freeze delay my refund?Officials say no. We’ll see.

Q: Where else can I get answers?The IRS website has solid guides (for now), and free filing options if you make under $79,000. If your financial picture is getting more complex, it may be time to hire a pro.

— Tax Time, But Make it Chill, Anna Davies, writer

P.S. Speaking of receipts… if a career break (or comeback) is on your mind, we’ve got a panel you need to hear. Real talk, real strategies — no fluff. RSVP now.

Read More

💰Keep More of Your Money ... with 4 tax hacks to remember next year.

📈DIY Your Taxes ... a free spreadsheet the experts say you should start ASAP.

🙏🏼Get Free Help ... when you've just gotta call an expert.

Memo to you and your dad: One in three Americans have either had scammers try to access their info, or sent cash to someone they definitely shouldn't have. Here’s how to protect yourself from fraud.

Most tariffs on Canadian and Mexican goods are on hold (again) — but that’s not stopping US border-town families from turning a trip to Mexico into the new Supermarket Sweep.

This is your weekly reminder that if you need a new car, now's the time to buy. Already own? Here are five ways you could cut down on your monthly car insurance premium.

Are you guilty of “youngism” in your hiring? This surprising bias is squeezing applicants out of the job market.

Here’s some not-so-fun math: Officially, the US unemployment rate is ~4%. But the number-crunchers don’t include people earning poverty wages (under $25K). If you run it back with that group in the mix, as many as one in four Americans are barely making a living wage.

Before you “heart” that Zillow listing, cross check this map to see just how much your electricity bill could be. That wainscotting is wasted if you can’t afford to turn on the lights.

Are we facing a potential recession or a “period of transition?" Here’s how that rebrand is affecting the market today.

Use the letters below to identify the word or phrase. Then, click to reveal the answer.

Clue: The tax break that lets you deduct state and local taxes from your federal bill. In 2017, a $10,000 cap was put in place — frustrating many taxpayers, especially in pricey states. With the GOP eyeing tax code tweaks, this deduction is back up for debate.

... to Go For the Big Job (Or Another Management Role)

If you've been waiting for a sign, hi. You're ready to level up to The Big Job, whether it's a C-suite, director, or another management role.

You’ll boost your long-term career earnings. You’ll help reset unfair expectations that, in heterosexual couples, women should leave the workforce or downshift their careers to cover more at home. And, more women in leadership means more advocates for the rest of us.

So let’s go. All month, we’re giving you the tips you need to go after the title –– and the pay –– you really want. Starting with a question we get a lot…

Q: How do I make a career pivot that I’m not qualified for on paper?

First, know you can do it — because men do it all the time. Here’s how to show a hiring manager that you're already the right fit:

✔️ Talk to people who’ve done it. Find others in the kind of role you want. Ask how they got there, what actually matters, and if they’ll take a look at your resume.

✔️ Pitch like you belong. Instead of waiting to meet every requirement, articulate how your distinct experiences and background have uniquely prepared you for this new challenge. Emphasize the innovative approaches you bring to the table and how your past successes can open doors in the new role.

✔️ Build a dynamic portfolio. Showcase your transferable skills through a collection of concrete examples — case studies, project summaries, or measurable achievements, plus recommendations from coworkers that highlight your cross-team collabs. This portfolio will serve as evidence of your impact and help decision-makers visualize your potential in the new position.

The massive tax cuts that Republicans passed during President Trump’s first term are expiring soon. Now, the band is back together for an encore, and it could affect your tax bill in 2025.

Here’s what one financial newspaper had to say (Lester Holt voice)…

“The US House of Representatives has passed a budget resolution that calls for trillions of dollars in tax and spending cuts, in a significant victory for President Donald Trump as he seeks to enact sweeping changes in fiscal policy. The resolution passed by 217 votes to 215 after a campaign by House Speaker Mike Johnson to push Republican holdouts to back Trump’s ‘big beautiful bill’. The bill, which will kick off another round of budget talks in the Senate, proposes $4.5tn in tax cuts, about $2tn in spending cuts and allocating hundreds of billions of dollars more for the military and border security over a decade.”

Source: Financial Times

Here’s what this means between the lines…

Passing a budget resolution ≠ passing a law. House Republicans are setting intentions and agreeing to manifest the messy details later.

Those messy details will include: extending the 2017 tax cuts, beefing up border and defense funding, lifting the debt limit by $4 billion, and likely paying for it by making cuts to social welfare programs.

See that vote tally? A group of holdouts almost tanked this team exercise. Basically every House Republican has to OK the final bill for it to pass.

What does it all mean for your taxes? It depends on where you live, how many deductions you can take advantage of, and how you earn your income –– but, generally, the more money you make, the less taxes you’ll pay under the GOP plan.

Trending products and brands our shopping team has been loving recently.

Until tomorrow, restock your lingerie drawer with Soma bras for just $29. We like this wireless bralette, which is super soft and molds to your shape.

From a colorful loaf pan to a hack for cleaning your makeup brushes, these random products from Amazon are genuinely worth your money.

Ulta's 21 Days of Beauty has officially begun. Until March 27, get 50% off a new slate of products every day. What treasures will today's sale hold? There's only one way to find out.

Psst…love our recs? Follow @skimmshopping on Instagram for more products, gifts, and services that are actually worth the hype (and the price tag).

Live Smarter

Sign up for the Daily Skimm email newsletter. Delivered to your inbox every morning and prepares you for your day in minutes.